A prototype isn’t just about proving your idea works, it also has to make sense from a business perspective and create real impact. In this chapter, you’ll connect the dots between the impact-driven side of your work (“Prototype in real-world testing: Collect feedback and measure impact”) and the business side (“Reality check for impact startups: Make sure your market analysis holds up”) to start building a model that’s both viable and mission-aligned.

This section is for you if …

- you’re planning to launch an impact startup or already working on one with your team.

- you have a clear understanding of your target group.

- you can clearly define the problem, your solution, and the intended impact.

- you’ve got the resources to build a prototype.

- you’ve already conducted a market analysis.

- you’ve defined a key metric (OMTM) for early impact tracking and chosen your approach to measuring impact.

Not quite there yet?

Check out the section that fits your current stage.

In this section, you’ll learn how to …

- refine your prototype based on feedback and market insights.

- build a business model that’s built to last.

- sharpen your impact metrics even further.

Making sense of your prototype test data

Analyzing your prototype test results is essential for making informed decisions as you refine your solution.

1. Organize your interview data and spot patterns

Start by collecting all your notes, observations, and recordings in one place. Then group the data by test task or by different parts of the prototype. Identify patterns and trends by looking for recurring issues or comments – especially moments that stood out as particularly smooth or frustrating.

2. Dig into the data

Prioritize your findings by rating how serious each issue is. Prioritize problems that multiple participants experienced. Quantify your results by calculating success rates for specific tasks and measuring time spent on different interactions.

For qualitative feedback, take time to understand comments in context. Highlight key phrases, recurring themes, and anything that signals deeper user needs or challenges.

3. Visualize what you’ve learned

Use charts or heat maps to highlight how participants interacted with your prototype. Customer journey maps or user flow diagrams are also helpful – they show each step a participant takes, from entry points to actions, decisions, and end goals. These visuals make it easier to spot friction points and areas for improvement.

What’s a customer journey?

Originally from the software sector, the customer journey can be adapted for any technology-based innovation. To apply it beyond digital products:

- Think in terms of participants or your target group – not just “users.”

- Track interactions instead of clicks or conversions.

4. Revisit your assumptions

Your test results may reveal that you misunderstood the core problem, focused on the wrong part of the solution, or selected the wrong test audience. Don’t hesitate to revise your assumptions based on what you’ve learned – and if needed, run another round of testing. If the results shift how you think about your impact, update your impact model and metrics to reflect those new insights.

Developing a business model and connecting it to your impact strategy

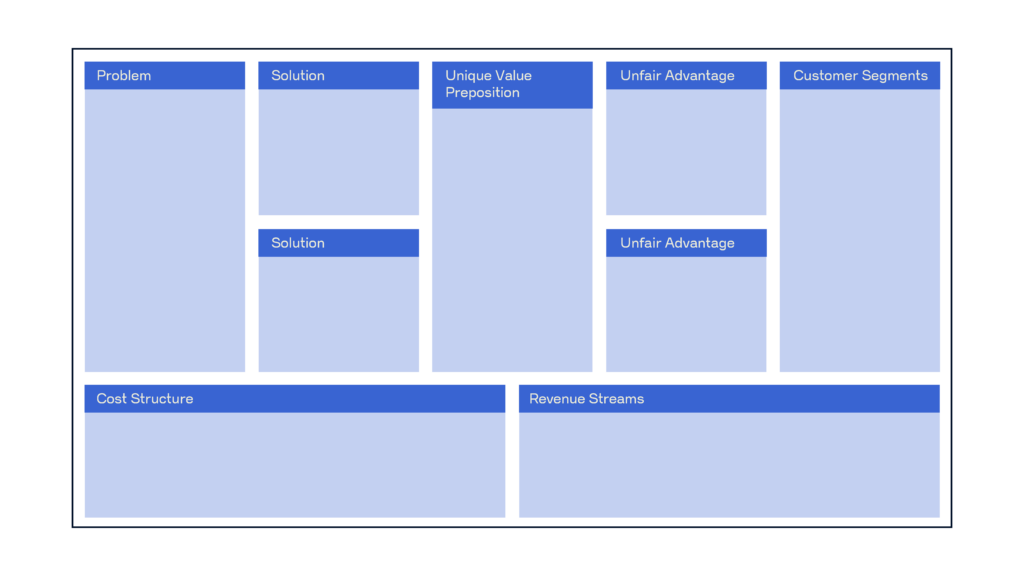

A strong business model is the foundation of of any successful impact startup. One useful tool to help you map it out is the Lean Canvas .

Here are a few steps to get you started.

Target group vs. customers

In the Lean Impact Journey, we distinguish between your target group – when you’re focusing on your impact and product – and your customers – when you’re working on your business model.

How you apply this distinction for your startup depends on your solution. In this playbook, the target group refers to the people who use or benefit from your solution. In some cases, these may be the same people; in others, they may not.

Keep in mind: your customers and target group may interact the solution differently with or benefit from your solution in different ways. To keep things clear, you can use two colors to show both groups in your Lean Canvas.

1. Clearly define the problem

Identify the one to three most important group faces. Then describe how those problems are currently being addressed – or not – by existing solutions.

If you’re feeling stuck here, go back to the chapter

“Problem, target group, and stakeholder analysis: Your first step toward launching an impact startup.”

2. Write a clear unique value proposition (UVP)

Create a simple, compelling core message that explains what makes your solution unique – and worth choosing. This is your unique value proposition (UVP). It should clearly express the value your solution delivers to customers and answer the question: Why you? Focus on how your startup meets customer needs better, faster, or more meaningfully than existing alternatives.

3. Define your customer segments

Identify who your customers and early adopters are, and describe these groups in detail.

If you’re feeling stuck here, go back to the chapter

“Problem, target group, and stakeholder analysis: Your first step toward launching an impact startup.”

4. Choose the right channels

Decide how you’ll reach your customers. Are they easier to engage online or offline? Does it make more sense to connect with them directly or through partners or platforms?

5. Describe your solution clearly

Once you’ve figured out how to reach your potential customers, describe your solution in a way that’s short, sharp, and easy to understand.

If you’re feeling stuck here, go back to the chapter

“Solution design: Creating a solution that drives real impact.”

6. Define your unfair advantage

An unfair advantage refers to aspects of your business model that competitors can’t easily copy or replicate. It’s about the unique features or resources that set your startup apart and are hard to imitate. Think about what makes your solution truly distinctive and difficult to duplicate – like a patent, for example.

7. Map out and assess potential revenue streams

Now it’s time to explore how your startup could make money. Some common revenue models include:

- Direct sale of products or services

- Subscriptions

- Freemium (a free version with paid upgrades)

- Licensing

- Consulting services

- Partnerships and sponsoring

Once you’ve listed the options, evaluate each one based on:

- How well it supports your impact goals

- Its long-term sustainability

- Its potential to scale with your startup

8. Explore creative business models

Consider ways to use profitable parts of your business to support areas that may generate less revenue but deliver high impact. A few options:

- Hybrid model: Mix different revenue streams to spread risk.

- Impact-based pricing: Adjust your pricing based on the social or environmental value your solution creates..

- Cross-subsidization: Use profits from one part of your business to fund less profitable, high-impact activities.

9. Examine your costs

Map out the major costs tied to both your business model and your impact model. Use color-coding or categories to keep things clear – development, marketing, team, etc. Be sure to include the cost of impact measurement and reporting.

10. Set your key metrics

Define the most important (impact) metrics that you’ll use to measure success. Use what you’ve learned from testing to refine your approach, and make sure both your solution and business model are built on solid ground. Your impact measurement should evolve as your startup grows. Use insights from prototype testing and market research to adjust them over time. This will increase your chances of achieving long-term impact and success, even as your business model evolves.

Next chapter: Develop your MVP

At this point, you’ve likely validated your prototype, demonstrated the impact and market potential of your solution and your business model and laid the groundwork for a sustainable business model. In other words …

- You’ve successfully tested your prototype and received positive feedback.

- You have early proof that your solution creates real outcomes for your target group.

- There are clear signs that there is a market for your solution and that it is scalable.

- You’ve developed a business model that supports both growth and impact

If all that sounds like you, you’re ready to move on to the next chapter and build the first basic version of your solution, your MVP.

Not quite there yet? That’s OK! You can always revisit the chapter “Prototyping for impact startups: Build your first prototype and identify key metrics” or head back to the overviewto find the step that fits your stage.

Tips for successfully validating your prototype, impact potential, market fit, and business model

Strike a balance between research and testing

Don’t spend too much time researching at the expense of real-world testing. Use your research as a starting point for practical experiments instead.

Dig deep into market potential

Focus on actual demand – hypothetical interest isn’t enough at this stage. Make sure to test whether potential customers are truly willing to pay for your solution.

Stay open to feedback

Be flexible and ready to adjust your solution and impact metrics based on the feedback you receive. Treat criticism as a valuable learning opportunity to sharpen your impact.

Test your prototype early

Don’t wait too long to start testing. Your prototype doesn’t need to be perfect – start as soon as you have a basic version ready to go.

Use real data

Validate your assumptions and impact metrics using actual data – not guesses. Run interviews, surveys, and tests with potential customers.

Focus on the core problem

Make sure you’re solving the right problem. Don’t waste time or resources on distractions.