Your minimum viable product (MVP) has shown that your solution works. Now you’re entering the growth phase – the stage where you bring your product to market, reach new customers, and take your startup to the next level.

This section is for you if …

- you’ve launched an impact-driven startup.

- you’ve clearly defined your target audience, the problem you’re solving, and the impact you want to create.

- your MVP has been tested and validated.

- you’ve mapped out your impact potential, market opportunity, and financing model.

- you have the resources in place to scale.

Not quite there yet?

Check out the section that fits your current stage

In this section, you’ll learn how to …

- turn your MVP into a market-ready product.

- grow your customer base.

- build effective marketing and sales channels.

- develop growth strategies to set your startup up for long-term success.

Get your MVP market-ready

Now it’s time to turn your MVP into a compelling product customers actually want – and are willing to pay for.

1. Optimize your solution

- Finish core features: Make sure every key function works seamlessly, even outside of a test environment.

- Increase efficiency: Streamline how your solution is delivered. For services that rely heavily on people, this may be harder – but look for ways to make things run smoother.

- Ensure scalability: Your technical infrastructure should be robust enough to grow with increasing demand.

2. Keep developing your MVP

Use insights from your MVP test users (see“Putting your MVP to the test: Measuring your startup’s impact”) to refine the user experience. Regular user testing helps make sure new features meet expectations – and helps you avoid building the wrong thing.

Tip

Create a release plan that lays out which features you’ll roll out next. Prioritize what brings the most value to your users.

3. Expand your team

As your product grows, so should your team. Bring in people with expertise in UX/UI design, product management, and marketing to round out your product development (see “Grow with impact: Team, processes, and culture for impact startups”).

From early adopters to a larger customer base

Scaling means reaching more of the people your solution is built for – and that takes a smart strategy. These five steps will help you move from early adopters to the mainstream:

Target group vs. customers

In the Lean Impact Journey we differentiate between the target group when working on your product and impact model and customers when talking about your business model.

How you use these two terms for your project depends on your solution. In this playbook, your target group includes both the people who use your solution and those who benefit from it.

Some solutions will have a combination of both as a target group.

1. Focus on the features that matter most

Start by building the features that offer the greatest value to your target audience and customers. Keep things lean – expand the scope of your product gradually, adding new elements around the core solution.

2. Keep improving the user experience

Continuously refine the design, usability, and functionality of your solution. Use user-centered design methods to better understand how people interact with your product – and make sure it meets their needs in the real world.

3. Expand beyond early adopters

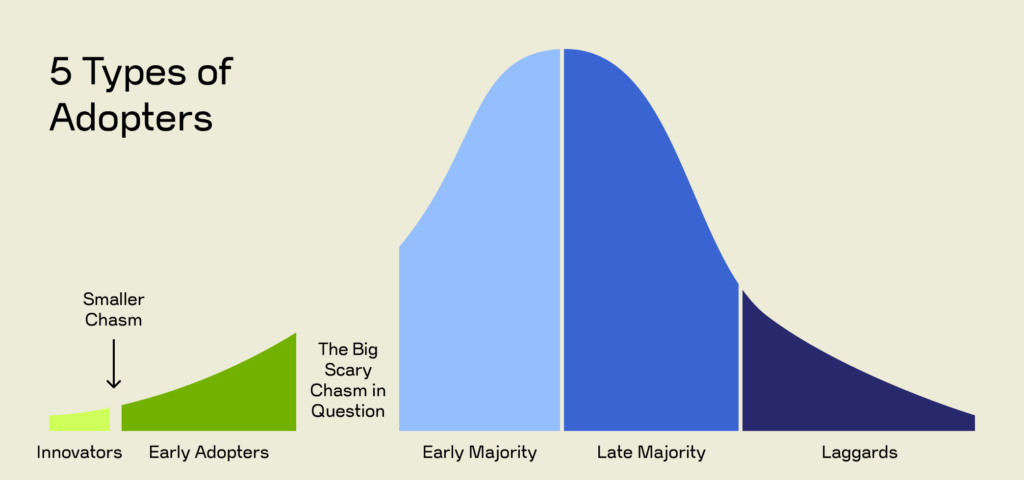

Grow your customer base beyond the early adopters. Here’s a general breakdown of adopter types to guide your strategy:

- Innovators (3%): Innovation enthusiasts who are eager to try new solutions.

- Early adopters (13%): Visionaries who quickly recognize value in new solutions.

- Early majority (34%): Practical users who want proven, reliable tools.

- Late majority (34%): More skeptical users who adopt only after widespread validation.

- Laggards (16%): Skeptics who are reluctant to adopt new solutions

4. Tailor your strategy to each group

Speak to each audience in a way that resonates. For innovators and early adopters, emphasize creativity, bold thinking, and your long-term vision. When targeting the early majority, focus on ease of use and proven results. To win over the late majority, highlight social proof, endorsements, and a strong track record. For laggards, present your solution as the new industry standard.

5. Share success stories

Use real-life examples from early adopters to help convince others to get on board.

Build your marketing and sales channels

Without visibility and a clear sales strategy, even the best product will struggle to gain traction. Here’s how to build both in a focused, strategic way.

1. Analyze where you’re starting from

First, gather as much insight as you can about your potential customers. Look at market data, run a competitor analysis to see which channels are working for others in your space, and assess your own performance Use tools like Google Analytics, social media dashboards, or customer surveys to get a sense of what’s working and where there’s room to grow.

A SWOT analysis can help you evaluate your current marketing and sales channels:

- Strengths: What’s already working well? (e.g., strong social presence, good SEO, high conversion rates)

- Weaknesses: Where are the gaps? (e.g., unclear messaging, lack of capacity for running campaigns)

. - Opportunities: What trends or partnerships could help you grow? (e.g., rising interest in ethical brands, potential collaborators)

- Threats: What challenges might slow you down? (e.g., competitors, limited budget, shifting market dynamics)

Once you have a clear picture, set goals using the S.M.A.R.T. framework. The indicators should be:

- Specific: Focused and clearly defined

- Measurable: Quantifiable

- Achievable: Realistic given your resources

- Relevant: Aligned with your broader objectives

- Time-bound: Set within a clear timeframe

2. Define your customer group

Create detailed profiles of your ideal customers, including their challenges, goals, and what they value most. You already started this process in “Problem and target group analysis: How to validate for impact startups”. Now’s the time to go deeper – with tools like personas or simplified version of the value proposition canvas.

Target group vs. customers

In the Lean Impact Journey we differentiate between the target group when working on your product and impact model and customers when talking about your business model.

How you use these two terms for your project depends on your solution. In this playbook, your target group includes both the people who use your solution and those who benefit from it.

Sometimes that’s the same group – sometimes it’s not.

3. Refine your unique selling proposition (USP)

Your USP is what sets your solution apart – and it’s the reason customers should choose you over anyone else. The Lean Canvas is a helpful tool to define your core value and communicate it clearly. In early stages, highlight bold ideas and your vision for change. As you grow, shift toward reliability and proven market fit.

Here’s how to use the Lean Canvas to sharpen your USP:

- Problem: What’s the core issue your customers are facing? Your USP should speak directly to that.

- Customer segments: Who exactly are your customers, and how does your solution meet their specific needs?

- Unique value proposition (UVP): Distill your message: Why is your solution better? Think clear, punchy phrases like “Faster. Smarter. More sustainable.”

- Channels: Where will your message land best? Consider content marketing, social media, and testimonials.

- Unfair advantage: What makes your USP difficult to copy? Maybe it’s proprietary tech, deep domain knowledge, or a powerful network.

4. Choose the right marketing channels and methods

Once your USP is clear, it’s time to fine-tune your marketing. A SIPOC diagram can help you understand and improve the flow of your marketing activities (see “Grow with impact: Team, processes, and culture for impact startups”

Effective marketing methods include:

- Content marketing to provide valuable content

- Social selling through social platforms to connect, engage, and convert

- SEO to boost your visibility online

- Referral marketing, turning satisfied customers into advocates

5. Choose the right sales channels

Build a multichannel sales strategy that combines both online and offline approaches. Revisit your existing sales processes and optimize them – again, a SIPOC diagram can help spot inefficiencies (see “Grow with impact: Team, processes, and culture for impact startups”)

Common sales channels include:

- Direct channels such as physical retail (in-store sales), email marketing, e‑commerce

- Indirect channels such as business partnerships, wholesalers, franchises

- Digital channels such as mobile apps, webinars, online training, and content-based sales like blogs, podcasts, and videos

6. Train your marketing and sales team

Even the best strategies won’t work if your team isn’t prepared to execute them. Make regular training a priority to keep your team sharp and aligned. To identify skill gaps and plan learning opportunities, check out “Growing sustainably: Team, structure, and culture for impact startups.”

Develop multiple growth scenarios

Planning for long-term success means thinking beyond the ideal case. It’s about anticipating different possibilities and preparing for what’s ahead. Here’s how to create solid, data-driven growth scenarios:

1. Look at your startup’s past growth

To make realistic projections, start by analyzing your historical growth. Review your revenue over the past few years and compare it with relevant industry benchmarks and competitors. Ask yourself: Has your growth also led to greater impact?

Example: A tech startup grows 20% year over year for three consecutive years. That trend becomes the baseline for its future projections.

To get a clearer picture, use key metrics like the compound annual growth rate (CAGR), the revenue growth rate or the customer growth rate. The formula for the revenue growth rate is:

(Current year revenue – Previous year revenue) / Previous year revenue × 100

2. Consider external factors that affect growth

Don’t just rely on internal data – external trends can shape your future just as much. A top-down approach, ooks at macro-level indicators like GDP growth, sector trends, or policy changes. A bottom-up approach starts with your own data – such as market share or monthly recurring revenue – and builds from there.

Expert insights, your management team’s strategic vision, and overall market sentiment can also help you spot risks and opportunities.

Look at market trends, shifts in customer behavior, and potential new markets to explore where you could expand next.

3. Build out realistic growth scenarios

You can use your data to map out different growth paths:

- Best-case scenario: Everything goes better than expected. Your solution gains fast traction, funding rounds are successful, and your impact exceeds targets. Think 50% more revenue or significantly higher customer numbers than planned.

- Base-case scenario: The steady middle ground. Growth follows historical trends, revenue is stable, and operations run as planned. Most customers pay on time, and the business scales gradually.

- Worst-case scenario: Here you assume the worst possible case. Growth stalls or declines. This could involve facing delays in product rollout, missed funding milestones, lower-than-expected impact, or unfavorable market conditions. The result would be a collapse in business.

Examples: Customer payments are delayed, projects cannot be fully invoiced, or sales efforts fall short.

4. Turn each scenario into a strategy

Once your scenarios are in place, use them to guide your planning: Double down on opportunities in the best case, strengthen your foundation in the base case and minimize risk and stay agile in the worst case. This way, you can stay focused but flexible – ready to pivot when needed and in control of your growth.

Next step: Impact measurement strategy

You’ve laid the foundation for your startup’s financial growth – now it’s time to track your progress.

Before setting up KPIs or building your baseline scenario, make sure your team, your structures and your organizational culture are ready for the next phase and fine-tune your impact management strategy.