Before you dive into what your prototype is telling you and start shaping your business model, it’s essential to understand the market you’re entering. A clear, well-informed market analysis lays the groundwork to grow your impact startup and find the right product–market fit..

This section is for you if …

- you’re getting ready to found an impact startup – or already building one with your team.

- you know exactly who your target group is.

- you can clearly explain the problem, your solution, and the impact you want to make.

- you’ve got the resources to build a prototype.

Not quite there yet?

Check out the section that fits your current stage

This section is for you if …

- you want exploring your market size and how it’s evolving.

- you want to spot trends and understand outside forces that could shape your market..

This chapter is all about developing and rolling out your business model, including the financial side of your solution.

We dig into how to design for meaningful impact here.

Step-by-step market analysis

A strong market analysis helps you understand your product’s potential and how to position it effectively. It provides essential insights to shape your product and business model – including market size and growth, your competition, alternative solutions, and your customer segments and their needs.

1. Identify the problem you want to solve

Before diving into market numbers, make sure you can clearly define the problem you’re addressing. Ask yourself:

- Problem and your USP: What problem are you solving? What makes your approach stand out? Clarity here will guide the rest of your analysis.

- Impact angle: How does your solution differ from traditional ones in terms of social or environmental benefit? Be specific and keep it short – what’s the positive change you’re driving?

.

Ideally, you have already tackled this in the chapter “Problem and target group analysis: How to validate for impact startups” and have clearly defined your solution under “Solution design for impact startups: How to reality-check your idea.” If not, consider the following steps:

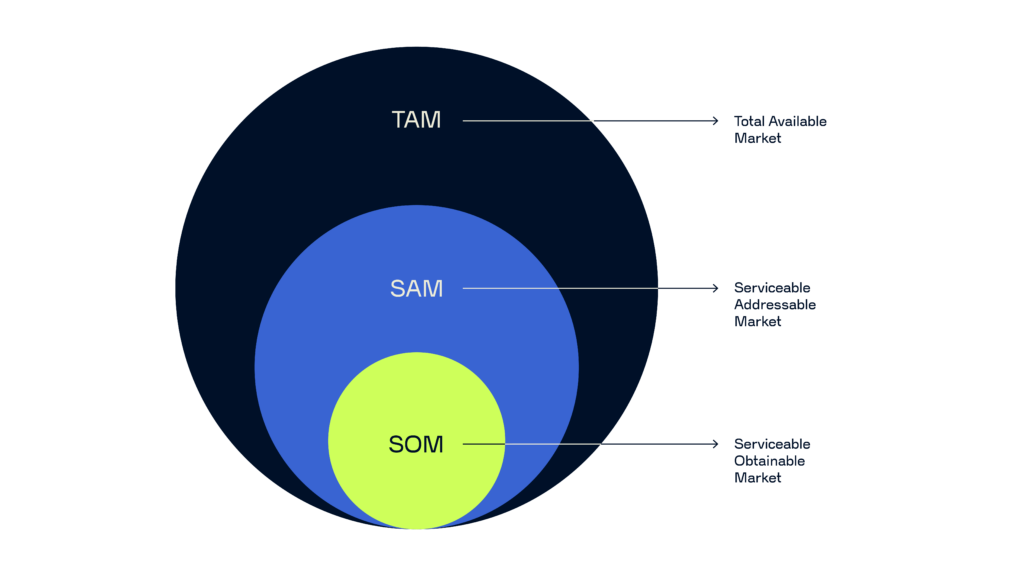

2. Determine your total addressable market (TAM)

Your total addressable market (TAM) is the full market your solution could reach in theory. The basic formula:

Total number of potential customers x average annual revenue per customer

To size your TAM, look for up-to-date industry reports, market data, and open sources – think government publications or trade association data. Also ask yourself the following questions:

- How big is the market really?

- Which products or services are truly part of the same market as yours?

- Who could benefit from your solution, even if you’re not reaching them yet?

3. Define your serviceable available market (SAM)

Your serviceable available market (SAM) is the portion of the TAM you could realistically serve. It’s the audience you could reach if resources weren’t a limiting factor. The formula is as follows:

Number of reachable customers x average annual revenue per customer

To calculate the SAM, narrow down your target group by geography, demographics, industry, or other filters. Consider your product specifications and sales capacity and ask yourself the following questions:

- Which customer segments are most likely to benefit from your solution?

- Are there geographic, demographic, or behavioral factors that shape your market?

- Are there technical, legal, or logistical barriers that could limit your reach?

4. Estimate your serviceable obtainable market (SOM)

Your serviceable obtainable market (SOM) is the slice of the market you can realistically capture with the resources and capacity you have right now.

Realistically achievable market share x SAM

To calculate it, assess where you stand in the market and how competitive your space is. If you’ve already explored existing alternatives in Solution design: Creating a solution that drives real impact, you’re off to a good start. Next, look at the resources you can actually use to win market share – like your sales capacity, marketing budget, and partnerships. And ask yourself the following questions:

- With the team and tools you have today, how much of your SAM can you actually reach?

- What competitive dynamics could limit or boost your ability to grow?

- How long will it take to get there?

5. Draw clear lines between TAM, SAM, and SOM

To make your market analysis solid and credible, define each segment – TAM, SAM, and SOM – clearly and separately. Avoid overlaps, use distinct criteria, and document your assumptions and sources so others can follow your logic. And ask yourself the following questions:

- Have you clearly defined non-overlapping criteria for TAM, SAM, and SOM?

- Can you clearly delineate each area?

- Are you sure you’re not counting part of your SAM again in your TAM?

6. Examine trends and external forces

Now it’s time to zoom out and consider the bigger picture. What industry trends, policy shifts, or social trends could accelerate – or block – your impact? Look at things like emerging technologies, regulatory developments, or growing interest in sustainable finance. Then think through what external risks – such as legal changes or economic volatility – might affect your path. Also ask yourself the following questions:

- What trends could shape the success of your startup?

- What external shifts should you keep an eye on so you can adapt quickly?

- Are there any political or legal changes that could affect your users or your solution?

Next up: Validate your assumptions

You’ve just wrapped up a key milestone – mapping out your market and identifying the trends that could influence your startup’s future.

‚Now it’s time to stress-test your assumptions. In the next chapter, we’ll walk you through how to connect with your target audience and get real feedback on your idea.