FIND YOUR WAY TO Ω

Good impact measurement & management are the guarantee for more impact for your impact startup or impact investment. The IMMPACT Guide supports you in this. It includes the maturity model IMMPACT Model and the associated playbook Lean Impact Journey.

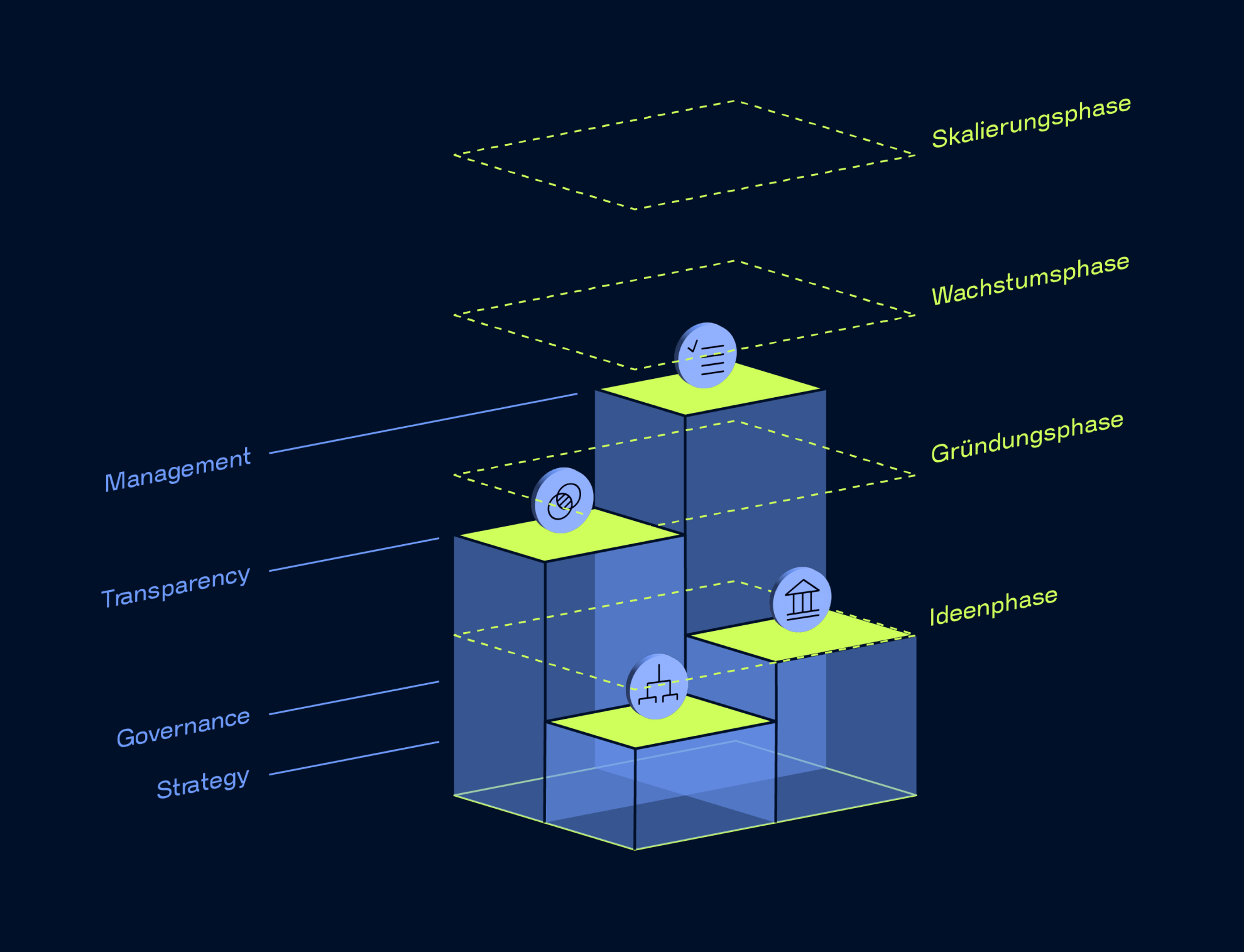

Ω MODEL

Whether you are a founder, investor or start-up consultant: our maturity model allows you to clearly see where an impact start-up stands and which next steps make sense. A great basis for strategy, planning and sparring — and free of charge.

Lean Impact Journey

This playbook is your deep dive into the IMMPACT model. We give you tips, context and frameworks in short chapters. Everything directly and quickly. The digital guide to a structured startup foundation with impact.

Our Mission

SHAPING THE FUTURE OF BUSINESS WITH Ω

The IMMPACT Guide helps founders of impact startups and the entire impact ecosystem, from investors to consultancies, to realize their full impact potential. We strengthen their ability to drive meaningful change and set uniform evaluation standards within impact oriented startup systems — making impact measurement and management (IMM) more accessible.

With the right tools – like our IMMPACT Model and Lean Impact Journey – which are built on proven methods, we help ensure that everyone in the ecosystem speaks the same language. Because real progress happens when we align and move forward together.

Our vision is an impact economy – a future where financial success and positive social and environmental change go hand in hand. When purpose and profit work together, we build a more sustainable and impact-driven world.

Blog

Events

We look forward to seeing you – live at conferences, meetups, festivals, or digitally at our free webinars. Let’s exchange ideas and learn together!

YES, I WANT TO RECEIVE NEWS ABOUT TOMORROW’S ECONOMY!

We respect your privacy and handle your data according to our privacy policy.

MORE

Ω FOR

ECOSYSTEM

DRIVEN BY

Ω

The project is a joint initiative of the Bertelsmann Stiftung, PHINEO, the Federal Initiative for Impact Investing and the Social Entrepreneurship Network Germany (SEND).

Together, we’re shaping the impact economy — a future in which businesses and financial markets prioritize positive impact.

Together with our partners, we’re strengthening the impact startup ecosystem. We offer guidance on measuring impact and securing funding, helping founders with social and environmental goals communicate their mission effectively and maximize their impact.

For SEND, joining the IMMPACT initiative is a key step in shaping the impact economy of the future. Our goal is to strengthen the ecosystem for impact-driven founders and provide targeted support to help them succeed.

Our goal is to make impact more tangible for all stakeholders. Through IMMPACT, we provide founders and investors with accessible, practical insights – helping them build their expertise and strengthen the impact economy.

Through IMMPACT, the Federal Initiative for Impact Investing (BIII) is working to create a stronger foundation for investing in young social enterprises. We offer targeted education on impact investing and its market, refine and standardize impact measurement practices, and enhance transparency through in-depth research.

CONTACT

Questions?

We respect your privacy and handle your data according to our privacy policy.